September 30, 2025

How much deposit do you need for an investment property in NZ?

The most common question we hear is: “How much deposit do I actually need?”. When it comes to investment properties in New Zealand, deposit requirements are typically higher than for owner-occupied homes. That’s because lenders consider investment properties a higher-risk loan category. Here’s what you need to know and how to make it happen.

Factors Affecting Your Investment Property Deposit

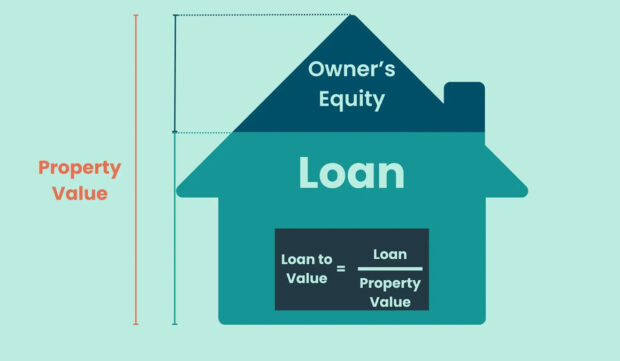

The Reserve Bank sets loan‑to‑value ratio (LVR) restrictions for investment property loans. Under current Reserve Bank settings, loans with an LVR over 70% are considered “high‑LVR,” and banks are permitted to only do a limited portion of these.

The Reserve Bank sets loan‑to‑value ratio (LVR) restrictions for investment property loans. Under current Reserve Bank settings, loans with an LVR over 70% are considered “high‑LVR,” and banks are permitted to only do a limited portion of these.

That’s why, in practice, most investors need to contribute at least 30% equity to qualify. There are however some exemptions, such as new‑build or construction loans, refinancing without an increase in borrowing, and Kāinga Ora loans (though these are rarely used for investments).

From 1 July 2024, banks must also manage lending above set debt‑to‑income (DTI) thresholds. For investors, borrowing above 7 times gross income is considered high‑DTI, and banks can only allocate a portion of new lending there. That means even with a 30% deposit, your income still needs to support the debt after realistic expenses and rental assumptions

Strategies to come up the required deposit

- Use equity in your home

Many investors release equity from an owner‑occupied property (typically up to 80% LVR on your home, subject to servicing) and combine it with cash savings. (Banks apply their own limits and affordability tests.) Talk to us about the most tax‑ and cash‑flow‑efficient way to structure this. - Target a new build

Because many new‑build/construction loans are exempt from LVR speed limits, banks may approve lower‑deposit investment loans on qualifying properties, still subject to full affordability and bank policy. This can be a useful strategy if 30% cash/equity is tight. - Blend sources

Combine savings,equity and a small family gift (with a simple gift letter) and keep records clean to provide clear proof of sources and avoid delays at approval.

What if I can’t meet the deposit criteria for an investment loan?

- Case‑by‑case: Depending on the property (e.g., qualifying new builds), your broader equity position and servicing, it can still be possible. Talk to us to explore options of what’s possible for you

- Non‑bank lenders: Sometimes offer more flexibility at higher rates/fees. Suitability depends on your time horizon and exit plan. We’ll outline pros and cons.

Work with us and get your Investment Loan structuring right from day one

Your loan structure influences cash flow and long‑term outcomes. We’ll help you weigh interest‑only vs principal‑and‑interest, split‑fixing, and revolving facilities. We also coordinate with your accountant to align lending with your investment strategy.

Rules change, markets move and great advice is what keeps you safe and on track. If you’re weighing up your deposit options for a rental, talk to Capital Advice for a tailored plan that fits your numbers and your goals.

FAQ’s

What is the minimum deposit for an investment property in NZ?

Most banks in New Zealand require at least a 30% deposit for investment properties due to Reserve Bank LVR rules. However, exemptions apply for new builds and certain refinancing situations.

Can I use equity from my home as a deposit for an investment property?

Yes, many investors use equity from their owner-occupied home (up to 80% LVR) to fund an investment property deposit, combined with savings or other sources.

Are there exemptions to the 30% deposit rule in New Zealand?

Yes. New builds, Kāinga Ora exemptions, and some refinancing situations may allow lower deposits, subject to lender criteria and affordability checks.

Do non-bank lenders require the same deposit as banks?

Non-bank lenders may offer more flexible deposit and lending options, but often at higher interest rates and fees. Suitability depends on your investment goals and timeline.

How do new debt-to-income (DTI) rules affect investment property deposits?

From July 2024, borrowing above 7x gross income is considered high-DTI. Even with a 30% deposit, your income and expenses must meet bank affordability tests.

Share this

Date

September 30, 2025