Capital Advice News

Stay informed of industry updates with the latest news on New Zealand interest rates, mortgages and insurance.

February 16, 2026

Offset Mortgages vs Revolving Credit: Which Option Is Right for You?

If you are looking for ways to reduce the interest you pay on your mortgage or pay it off faster, you have probably heard about offset loans and revolving credit facilities. Both are popular tools in New Zealand and, when used correctly, can make a meaningful difference to how quickly you build equity in your home.

February 9, 2026

How to Finance Your Home Renovation: A Practical Guide for New Zealand Homeowners

Renovating your home improves your living and usually adds value to your property. If you are updating kitchens and bathrooms or planning a more extensive makeover, one of the first questions is the same for many homeowners: How can I fund this renovation?

November 13, 2025

What Is Mortgage Pre-Approval and Why Should You Get One?

Buying a home is a big decision, and mortgage pre-approval can give you a valuable head start in the process.

October 14, 2025

Top Tips for First-Time Property Investors: What You Need to Know

Stepping Into the World of Property Investment Investing in property is one of the most popular ways Kiwis grow wealth, but the first step can feel daunting.

October 3, 2025

Tips to Help First‑Time Buyers Get on the Property Ladder

Buying your first home should be exciting, not overwhelming. As Wellington‑based mortgage advisers who work with clients across New Zealand, we help first‑home buyers organise smart finance, and avoid costly pitfalls.

September 30, 2025

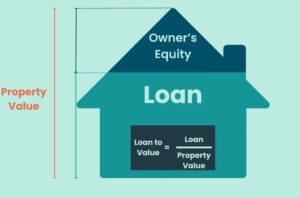

How much deposit do you need for an investment property in NZ?

The most common question we hear is: “How much deposit do I actually need?”. When it comes to investment properties in New Zealand, deposit requirements are typically higher than for owner-occupied homes.

August 25, 2025

How Long Does Mortgage Approval Typically Take in New Zealand?

House hunting runs on deadlines. This guide sets clear expectations for timeframes, from first conversation to final approval, so you can plan viewings and negotiations with confidence.

April 4, 2025

Understanding Reverse Mortgages: How They Work and Who They Are For

Many homeowners in retirement find that everyday costs can become difficult to manage on a fixed income.

March 21, 2025

How to Use Your Home’s Equity For Buying a Rental Property

Property ownership in New Zealand provides a powerful opportunity for wealth and generating long-term financial security.

March 18, 2025

What Can Stop You from Getting a Mortgage

Many lenders have tight restrictions on whom they lend money to. Even a minor mistake can lead to your mortgage application being rejected.

February 9, 2025

The Different Types of Home Loans on Offer in NZ

A home loan is a gateway to owning your dream home. With various types of home loans available in New Zealand, it’s essential to choose the one that best fits your financial situation and goals.

January 21, 2025

What Does A Mortgage Broker Do? How A Mortgage Broker Can Streamline The Process

Are you going to purchase a new home? If so, then you’re most likely wondering about mortgages and home loans.A Mortgage Broker can help you secure the finances you need to buy the home of your dreams. So, it’s essential that you take the proper steps to avoid mistakes and potential rejection.

November 6, 2024

When You Should See A Mortgage Broker

Securing a mortgage can feel daunting at times, especially when you consider how many options, lenders and rates are available. When you’re struggling to determine the right choice for you, a broker can provide you with clarity and much-needed assistance.

November 5, 2024

Is It Worth Getting A Mortgage Broker

Buying a new home in Wellington is an exciting yet complex process. Having enough money to purchase a home can be a challenge for the average person, so many choose to work with professional mortgage brokers to guide them through the mortgage process.

November 4, 2024

What Are Pros and Cons of Using a Mortgage Broker?

When navigating the world of home loans in NZ, having a knowledgeable mortgage broker on your side can make a significant difference. However, understanding if using a mortgage broker is the right choice for you and loan involves considering both the benefits and potential drawbacks.

September 27, 2024

How Can A Mortgage Broker Help You?

Understanding New Zealand’s home loan and mortgage market can be an overwhelming and stressful experience, especially if you’re a first-home buyer or new to the world of mortgages. So, we at Capital Advice are here to assist you. Our team of experienced NZ mortgage brokers can make a difference by helping you understand your opportunities.

June 8, 2016

Financial stability reason for unchanged OCR

The Reserve Bank may have left the OCR unchanged – due to a more upbeat economic assessment – this morning, but economists continue to expect a further cut to come.

June 8, 2016

Property values continue to grow, and not just in Auckland according to QV

The latest QV House Price Index is out and confirms a continuation of previous trends. Auckland values have continued to rebound after their short and shallow drop, while much of the rest of the country is also rising.

March 16, 2016

New Zealanders lack insurance on their most important asset

Ask the average person what their most valuable asset is, and it is likely they will reply that it is their home. In general, this is not true. The most valuable asset of any person under the age of about 50 is their future income.

March 16, 2016

House prices on the up across NZ!

House prices are on the up in most parts of the country according to Trade Me stats. This is certainly true in Wellington with most properties selling well above rateable values.

June 8, 2016

Welcome to May’s Capital Comment…

Well we seemed to have skipped Autumn and marched straight into Winter! It has been pretty grim out there! We have been amazingly lucky with the weather but it was always going to end sooner rather than later! Not so the low interest rates though with strong suggestion that the OCR will be cut again on the 9th June. In reality I still think it is unlikely that we’ll see much change to the fixed rates even if the OCR is cut with possibly just the odd rate dropping below 4% in the form of a special…special for who though…?!